How You “Do Money” Is How You Do Everything

Most of us think of “money” as numbers on a screen with budgets, accounts, bills.

But money is also a relationship.

It’s something we reach for, pull away from, chase, idealize, avoid, or try to control.

Take a moment to consider this question:

If money were a person in your life, what kind of relationship would you have right now?

Just like in human relationships, our patterns with money reflect our attachment style and the unconscious ways we seek safety, connection, and worth.

When you start to view money as a relationship rather than a transaction, you begin to see that the same attachment dynamics that play out with people… play out with your finances.

How Attachment Shapes Your Money Story

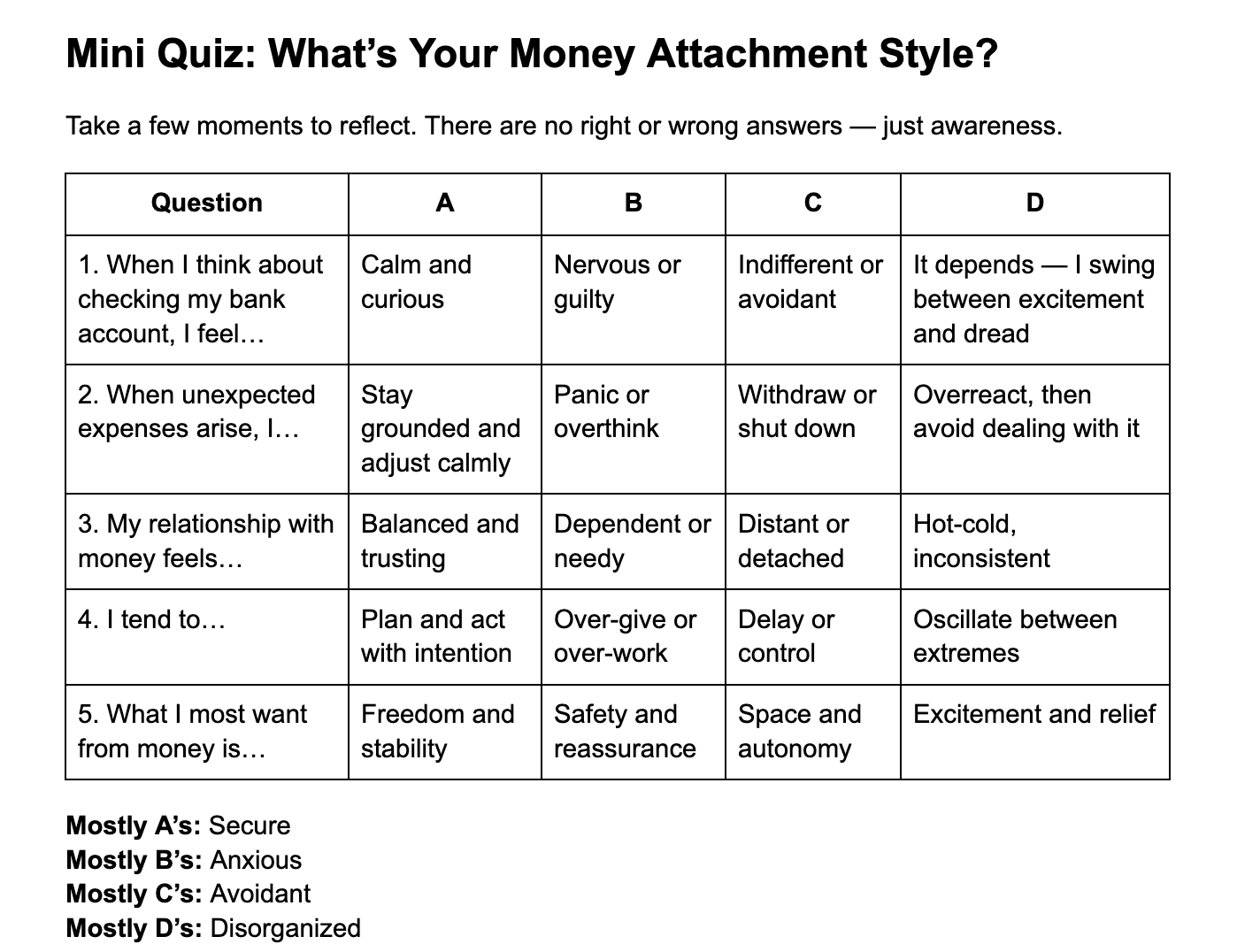

Psychologists describe four main attachment styles —

Secure,

Anxious,

Avoidant, and

Disorganized (or Fearful-Avoidant).

Each one has its own emotional logic, its own love language… and yes, its own money language.

Now that you have your answer, let’s explore the different attachment types:

1. Secure Attachment:

“I trust myself and money to support me.”

Core pattern: Safety and self-trust.

You see money as a partner, not a parent. You can give and receive, plan and play.

You tend to have balanced habits i.e. saving and spending intentionally, and can recover from financial stress without spiraling into shame.

Watch for: Over-responsibility or “doing it all” for others financially.

Heal by: Allowing yourself to rest in enoughness knowing that you are supported, even when you’re not striving.

2. Anxious Attachment:

“Money will leave if I don’t hold on tight.”

Core pattern: Fear of loss or instability.

You may check your bank account multiple times a day or panic when you spend. You might over-work, over-give, or say yes to things you don’t want because you crave financial or emotional reassurance.

Watch for: Emotional spending (to feel safe or validated) or self-sacrifice (“I’ll go without so others feel okay”).

Heal by: Cultivating inner security and learning to self-soothe your nervous system before making financial decisions.

3. Avoidant Attachment:

“I don’t need money… I’m fine.”

Core pattern: Independence and control as protection.

You might keep your finances private, dislike talking about money, or downplay its importance.

You prefer autonomy, but that can lead to isolation or missed opportunities for support and collaboration.

Watch for: Under-earning, avoiding systems or planning, or keeping money “at arm’s length.”

Heal by: Letting money become part of your emotional life — allowing trust, partnership, and shared goals to exist.

4. Disorganized Attachment:

“Money both scares and excites me.”

Core pattern: Push-pull dynamics.

One day you’re manifesting abundance; the next you’re convinced it’s all going to disappear. You may swing between extremes — binge-spend then freeze, take big risks then shut down.

Watch for: Chaotic money cycles and nervous system burnout.

Heal by: Practicing gentle consistency — simple routines (weekly check-ins, small goals) to teach your system that stability is safe.

How to Heal Your Money Attachment

Notice the pattern — awareness is the first repair.

Pause before reacting — take three deep breaths before making a financial choice.

Name the emotion — “I feel scared / avoidant / pressured / excited.”

Re-parent your inner relationship — speak to yourself as you would to a loving partner: “I’m here. We’re safe. We can handle this.”

Rebuild consistency through simple weekly check-ins, gratitude tracking, or mindful spending rituals.Healing your attachment to money isn’t about changing how much you have. it’s about changing how you relate to what’s already here.

I often say, how you “do money” is how you do life.

The way you relate to your finances mirrors how you approach love, creativity, work, and worthiness. When you make your relationship with money more secure, patient, and loving — everything else begins to follow suit.

Want to go deeper?

Book in a free call or work with me 1:1 to understand your patterns, triggers, and healing path.

Lea x